Tax by Province

Overview

We make some changes for the tax, make the product category tax can be applied for certain provinces, and make each tax rate can be excluded from certains branches.

Based on the images provided, the following changes have been implemented to the tax system:

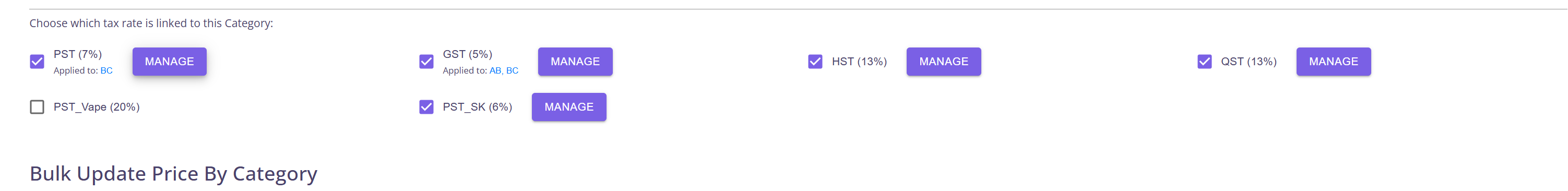

1. Province-Specific Product Category Tax

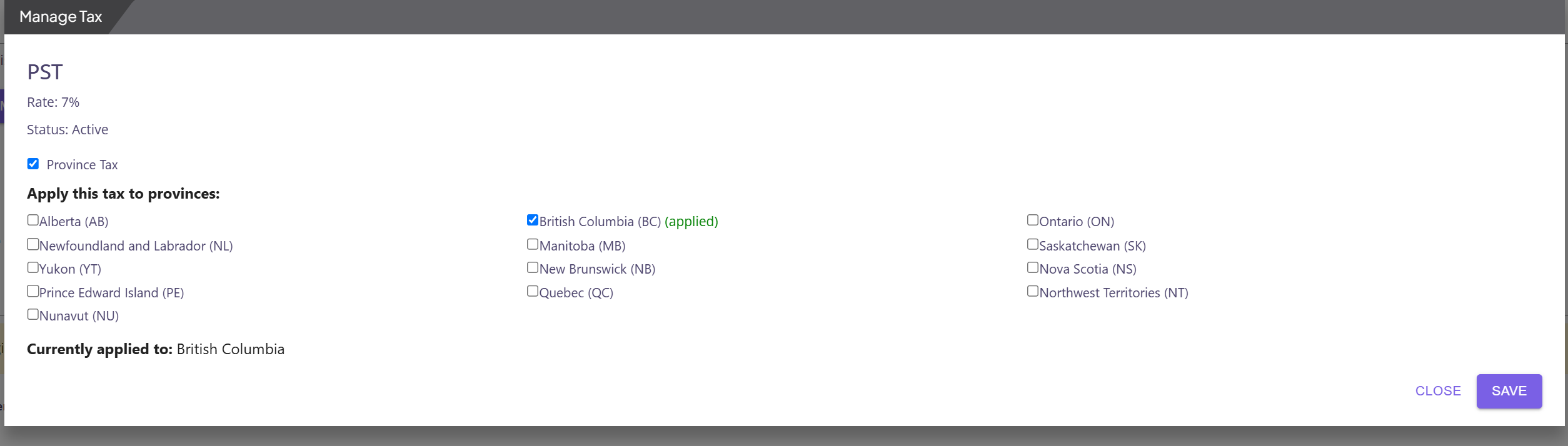

We have enhanced the tax system to allow product category taxes to be applied selectively to specific provinces. This means that a particular tax category can now be configured to apply only in designated provinces rather than universally across all locations.

By default, the tax will be applied to all provinces, and all taxes in the system will show up in the category save page. This ensures backward compatibility with the previous implementation while providing the new flexibility for province-specific configurations.

If you select “province tax” and pick tax that needs to be applied, we will only apply tax for the province you selected.

Key benefits:

- More granular control over tax application based on regional requirements

- Ability to comply with province-specific tax regulations

- Simplified management of complex tax scenarios across multiple regions

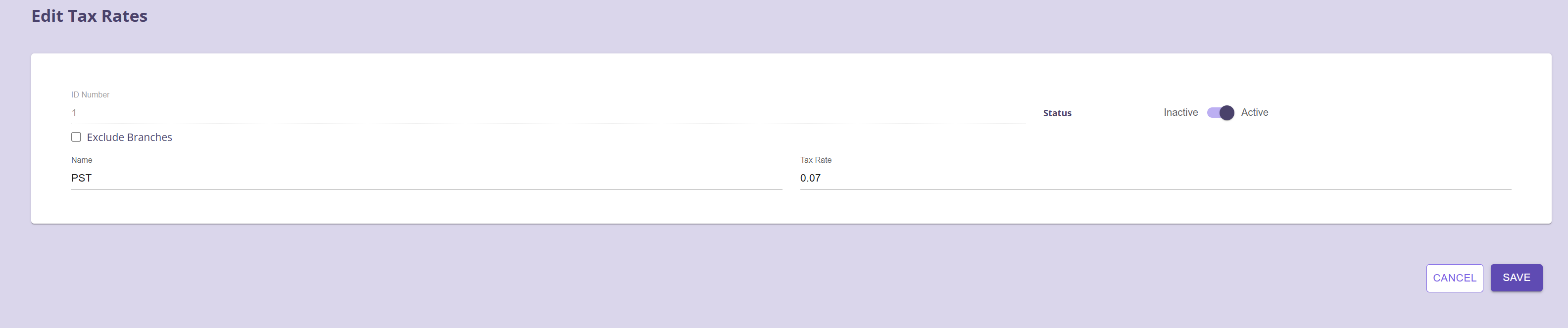

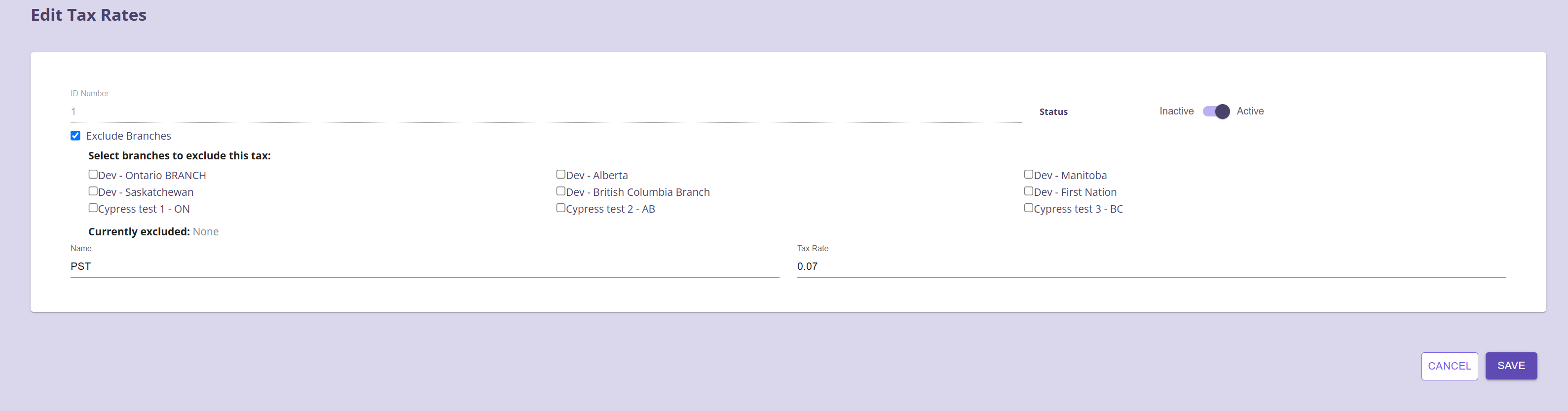

2. Branch Exclusions for Tax Rates

Each tax rate can now be configured with branch exclusions. This feature allows you to specify certain branches where a particular tax rate should not be applied, even if the province generally requires that tax.

Implementation details:

- Tax rates can be excluded from specific branches through the configuration panel

- This provides flexibility for special tax zones or branch-specific tax exemptions

- Branch exclusions can be easily managed through the admin interface

3. Technical Implementation

The tax calculation system has been modified to check both province applicability and branch exclusions before applying any tax to a transaction. The system now follows this logic:

- Determine which tax categories apply to the product

- Check if the tax category is applicable to the current province

- Verify that the branch is not excluded from the tax rate

- Apply the tax only if all conditions are met

4. Configuration Steps

To configure these new tax features, administrators should:

- Navigate to the Tax Management section in the admin panel

- Select the product category tax to modify

- Use the province selection tool to specify which provinces should have this tax applied

- For each tax rate, use the branch exclusion tool to select any branches that should be exempt

- Save changes and verify the configuration through test transactions

These enhancements provide greater flexibility and precision in tax management across different geographical locations and business units.