British Columbia PST Vape Calculation

In this article, we will dive into the calculation process of the PST and GST for vape products in British Columbia.

The tax for Vape Products is composed of two components: GST (Goods and Services Tax) at a rate of 5% and PST_Vape (Provincial Sales Tax for Vape Products) at a rate of 20%. These taxes are applicable to the purchase of Vapour Products, which include:

- Vaping devices (e.g. vaporizers and vape pens)

- Cartridges, parts and accessories for these devices

- Vaping substances (e.g. cannabis e-juice)

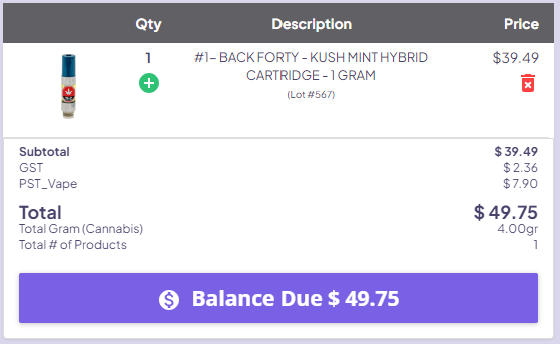

Calculation Example:

- The retail price of this product is $39.49

- $39.49 + 20% PST_Vape ($7.90) = $47.39

- $47.39 + 5% GST ($2.36) = $49.75

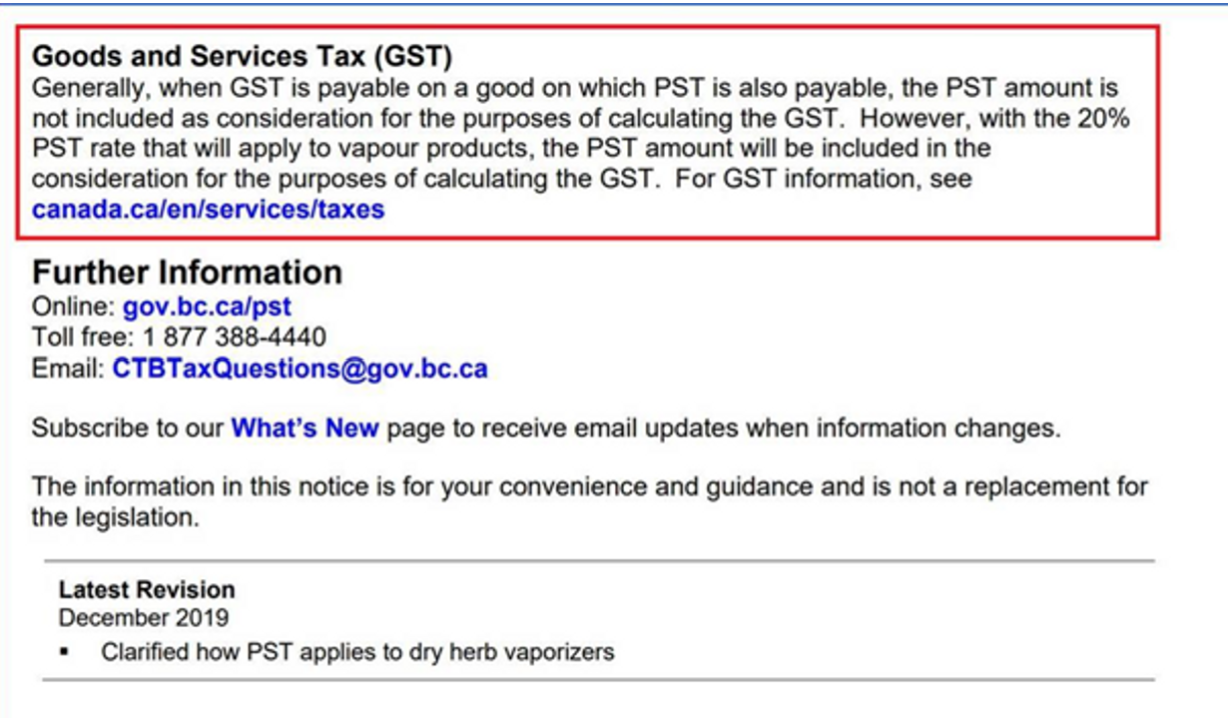

NOTE: Based on the regulatory requirement, GST has to be compounded, meaning that it is calculated based on the total amount including both the retail price and the PST_Vape. This ensures that the appropriate amount of tax is applied to the final purchase price of the vape product.

Resource: https://www2.gov.bc.ca/assets/gov/taxes/sales-taxes/publications/notice-2019-005-sellers-vapour-products-pst-rate-increase.pdf